United Kingdom based property and business consultancy

GreenBank Capital announced that Staminier completed the acquisition of The Substantia Group Limited pursuant to the terms of acquisition announced by the Company on 16th February 2021. (currently 49% owned by Greenbank)

Highlights:

- Substantia acquisition includes pipeline of development projects with a Gross Development Value of £800m (C$1.4bn)

- Substantia well placed to help Staminier achieve a valuation of £39m (C$67m) on its first 13 acres of land at London Gatwick Airport against a purchase cost of only £6m (C$10m)

- Substantia will also assist Staminier maximise value in relation to Staminier’s latest option agreement for 15 acres of land also at Gatwick Airport.

Substantia is a United Kingdom-based property and business consultancy offering clients a wide range of outsourced services. Substantia works with or for Blue Chip companies and independents alike, based both in the UK and overseas, including: British Land Plc, U&I Group Plc, Netflix, Sainsburys and Tesco.

Substantia has a contracted pipeline of development projects which it is undertaking either on its own account (taking options over land and pursuing planning /zoning) or on behalf of clients (as adviser or project manager) for a total gross development value exceeding £800m (C$1.4bn) over the next five years. Expected profit due to Substantia over that period is £15m (C$26.25m). Had Substantia been able to buy or option the land and fund the planning process itself, rather than source and negotiate the projects mainly on behalf of clients, the likely profit accruing to Substantia would exceed £80m (C$140m).

The ability to bring Substantia’s planning/zoning related expertise to bear for the benefit of Staminier is particularly valuable in relation to Staminier’s recently announced additional option over 15 acres of land adjacent to London Gatwick airport which has (with the right planning permission) the potential to help meet burgeoning demand from online retailers for storage and logistics facilities in the UK. The additional option increased Staminier’s land options at Gatwick to 28 acres. Recent valuations achieved for land with planning permission in the Gatwick area have been approximately £3m (C$5.71m) per acre (see amazon and Brymec warehouse image below), or £39m (C$67m) in relation to Staminier’s first 13 acres against a land cost of only £6m (C$10m) were Staminier to exercise its options to buy; and Substantia is currently undertaking an appraisal in respect of Staminier’s additional 15 acre option in order to maximise its potential value.

Please click on relevant press releases below;

Greenbank Capital Portfolio Company Staminier Raises C$17m, And Completes Substantia Acquisition

Greenbank Capital announces agreement with The Substantia Group to help execute growth strategy

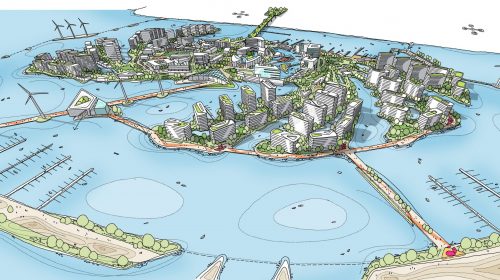

Multi £bn GDV Sustainable City Development

Landmark residential, retail, hotel & university development within 1 hour of London to be led by Greenbank portfolio company Substantia.

GreenBank Capital’s portfolio company Substantia (49% owned by Greenbank) is poised to work alongside Lead8 and Savills.

Award winning international design architects firm, Lead8, have drawn up the initial plans and will be engaged to develop more detailed plans as the project progresses. Savills, the international real estate specialists, also form a key part of the team behind the project. The concept behind the plan has also had significant local support including that of the area’s Member of Parliament.

Phase One of the plan is to agree, with both the Local and National Governments, on which of the three possible areas to build 3,500 residential units, a state-of-the-art University, retail and hospitality units – including hotels, restaurants and bars – along with the supporting transport and infrastructure modernisation required. The intention is for the project to include a mixture of facets that will prove highly attractive to people across the whole of the local community as well as drawing in buyers and visitors from further afield. Enhancing the appeal and profile of the local area as an important and attractive “destination” in its own right, as well as a commuter centre for London, is a theme that will underpin the whole project. Phase One also includes obtaining options from relevant Government bodies.

Phase Two is to partner with international developers to obtain detailed planning/zoning permission after having secured the options; phase three is to develop the City in partnership with international developers and large institutional or Sovereign Wealth funds; and phase four is the sale of the real estate. Successful completion of each phase represents highly profitable potential exit opportunities.

Substantia already has an existing portfolio of development projects – either as principal or adviser – exceeding £800m (C$1.4bn) of Gross Development Value. This Project, when successfully completed, is expected to have a Gross Development Value exceeding this figure.

Above is nearby land along the Thames Estuary

Thames Estuary 2050 Growth Commission envisages 1.3m new jobs being created, 1m new houses being built and £115bn GVA added to the region’s economy.

Please click on relevant press releases below;