Insightful Investment

Consultancy Services

Retail Investment

GreenBank allows retail investors exposure to private companies

Private Equity investments are usually reserved for institutional investors, with retail investors typically excluded from these opportunities.

However, GreenBank allows retail investors exposure to exciting private companies through purchasing GreenBank shares.

Mergers and Acquisitions

GreenBank offers support to businesses for all M&A processes.

Whether you are looking to sell or expand your business, GreenBank can search the market to find other companies that align with yours.

From introduction to completion, we can support you to create a coherent business plan and accounts for sale or purchase. We we also help you negotiate the best possible price.

Business Accelerator Programme

GreenBank provides access and support for new and growing businesses.

Our accelerator programmes typically last 3-6 months as we look to help develop and grow your business. GreenBank offers potential investment, access to investors, and co-working space if required.

Under the guidance of business professionals, we offer support from mentors and other companies within our accelerator network.

Operations

GreenBank Capital views Operations as the link between corporate strategy and success.

Efficient practices yield stronger results and a competitive advantage in the modern era of business. Now more than ever, companies often need support to benefit from sustained, inclusive growth.

GreenBank Capital actively transforms businesses from good to great, often infusing technology and streamlining processes to deliver the best results.

Communications

GreenBank can provide support with Marketing Strategy and PR.

Our internal team are well-versed in all forms of corporate communications and can help new and existing businesses alike to develop their brand identity.

We can develop and build websites, social media channels and more conventional PR strategies.

Business Planning

GreenBank helps you realise your goals in business.

We work with our portfolio companies to establish where the business is and where it needs to be.

We offer mentoring, workshops, and general advice for generating comprehensive business plans, which are often required for financing or loans.

Management Accounts

GreenBank can assist your business with their quarterly or annual MA.

Good financial reporting practices are vital for any business. Managers use accounting information in decision-making and to assist in the management and performance of their control functions.

Managament accounts measure past performance as a basis for improving, used to avoid cashflow problems, manage liquidity and to determine where to focus attention in order to improve profitability.

Fundraising

GreenBank helps you raise capital when your business needs it most.

Our team helps your business identify the most cost-effective and suitable fundraising options available.

We establish relationships with banks and and boutique lenders on your behalf, to obtain the best possible terms for bridging loans, short term loans, retail finance and other flexible options.

Asset Backing & Property Potential Realisation

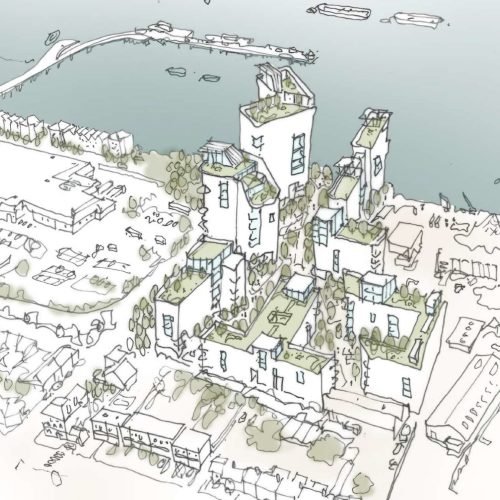

Planning

In financial terms, GreenBank is attracted to the major increase in land value resulting from successfully obtaining planning consent for development projects.

GreenBank can assemble a highly qualified and experienced team of planning and development experts to ensure that each potential development has the highest possible chance of obtaining local authority approval with community support.

GreenBank offers a complete, one-stop service that demystifies property management by helping clients identify the best possible options for development, proactive asset management efficiently advising on potential planning gain or increased income yields.

Property Solutions & GDV

GreenBank offer full Property Solutions, including the calculation of the potential Gross Development Value (GDV).

GreenBank also assists through: cost effective recruitment of professionals for the project, management of the community/political engagement to the submission of the planning application, and eventual outcome. Our solutions are extremely cost effective and time efficient due to us selecting from a vast pool of professionals, in all of the expert fields necessary for a project.

As an example we often negotiate success fees for our Architects, Planning Consultants and other professionals to ensure our clients cashflow is at a minimum, expectations are realistic and that the team is highly motivated to succeed.